Ali's Chat Strike

Markets

USD to RUB: 62.2854 (.36%)

BRENT CRUDE: 74.05 (1.65%)

IMOEX: 2318.90 (.20%)

RTS: 1172.29 (.63%)

Top Story

China's WeChat Pay launches in Russia

NEWS: WeChat, owned by China's internet giant Tencent, has launched its mobile payment service WeChat Pay in Russia.

CONTEXT: WeChat, a Chinese messaging app, is used by 980 million people in China. The launch of its payment app in Russia is aimed at Chinese consumers, the only ones who currently use the service. "Russian Amber" -- a chain of stores in St. Petersburg -- is the first chain to accept WeChat Pay thanks to its popularity with Chinese tourists.

The Central Universal Store (TsUM) in Moscow, a large mall for expensive brand-name goods, is currently working out how to incorporate WeChat Pay. The number of Chinese consumers visiting TsUm has reportedly grown 70% in the last year. This growth has been helped by moves to accept payments from China's UnionPay, setup WeChat Pay and Alipay systems, hiring consultants, as well as offering competitive prices.

Russian bank VTB -- present across the wider post-Soviet space -- and vodka company Russian Standard are also looking into WeChat Pay. Russia is trying to build up a domestic competitors to WeChat Pay by partnering with Alibaba's Alipay, but little progress has yet been made.

TAKEAWAYS: The lede here is actually buried in the story concerning TsUM about moving to set competitive prices, or what TsUM terms "Milanese prices." Prices for imported European goods in Moscow can be pretty crazy, no thanks to import schemes, administrative costs, and other minutiae that hit consumers' pocketbooks. Many Chinese tourists flying to Moscow can probably afford European vacations too. Moscow stores will have to compete.

The introduction of WeChat Pay is also proof of the Russian private sector's struggle with external partners in China. Alipay has thus far been a bust, though there may be a Russian app soon enough. Just wait for the absurd legal backflips that will be used to try and force Russians to use it.

Chart: Number of Chinese people in Russia

Red = # of Chinese people coming to Russia (millions of people)

Blue = # of Chinese tourists coming to Russia (millions of people)

The Energy Fix with Nick Trickett

Baghdad has again asserted that Rosneft’s contracts with Iraqi Kurdistan violated its constitution, though it’s clarified that it “won’t strongly affect our relationship” with Russia. However, their willingness to note that Lukoil and Gazprom respect Baghdad’s legal sovereignty when signing contracts should be another reminder that Rosneft’s proclivity for charging in and asking forgiveness instead of permission does have limits. The news parallels Rosneft’s “tests” easing OPEC production cuts. The company estimates it can bring over 100,000 bpd of production online in a few days. In order to bring domestic benzine prices down, the company has also suggested reducing exports of refined products. Rosneft has to delicately balance its social role for points with the Kremlin while pressuring OPEC production cuts as much as possible.

Lukoil is looking to build a polypropylene plant with a capacity of 150,000 tons a yearin Bulgaria, adding to its Balkan portfolio. It’s also hoping to buy into the Azeri gas fields Umid and Babek in the Caspian, a logical parallel move after announcing it would freeze its projects in Iran due to sanctions risks. The move is no surprise given the company’s conservative spending plans, a play meant to improve shareholder – and CEO Vagit Alekperov’s – returns.

Despite Lukoil’s caution, word broke that Pakistan and Russia were close to signing a pipeline deal that would transport gas from an unnamed Iranian field to Pakistan. But given that the source was Pakistan Today and Gazprom or Rosneft would have to finance this large project largely out of pocket – China distrusts Russia’s SOEs at this point – it’s unclear where the money comes from. The project would be a good leading indicator for Russian SOEs’ willingness to take risks in Iran, particularly as the proposed pipeline would further undermine Turkmenistan’s attempts to build TAPI.

Snapshot: Why won't he visit me? Benzine prices [RUS]

Prices for benzine were up 7.8% this year as of the end of May per figures from Rosstat. The Kremlin's response has been to meet with oil companies to pressure them to ease the burden on consumers during the summer. (Photo: Telegram)

Social Policy

Maternity capital rules loosened

THE STORY: Medvedev has signed a decree allowing maternity capital to be used to pay down a wider range of debts.

DETAILS: Maternity capital is one of Russia’s best-known social assistance programs. Introduced in 2007 in order to raise fertility rates, the program rewards parents for the birth of a second or subsequent child with a one-time payment of over $7,000 (as of 2017). Although the demographic merit of the program is unclear, it is very popular, especially among the middle class.

But maternity capital has complicated restrictions on how it can be spent. Parents can use it to construct or improve housing, to pay for education, or to add to the mother’s pension. One of the most popular uses of maternity capital is to pay down or refinance mortgages, but until now that has been limited to debts taken on after the birth of the second child. The new decree allows parents to pay down previous debts as well.

CONTEXT: Mortgage rates have risen spectacularly in Russia over the past few years. In 2013, Russians owed about $32 billion on mortgages; by 2017, that number had risen to $83 billion. Although mortgage debt in Russia still lags far behind the U.S. and Europe, mortgages are increasingly popular among the middle class, the target group for maternity capital.

The new rules make it easier to spend the maternity capital on mortgages, so they are likely to be popular. More than ten years after its introduction, the goal of the maternity capital is less demographic than economic and political. By facilitating credit restructuring with government support, these changes reduce the risk of default, but they may also encourage still more growth in household debt as families borrow under the assumption that they can use the maternity capital to pay their debts.

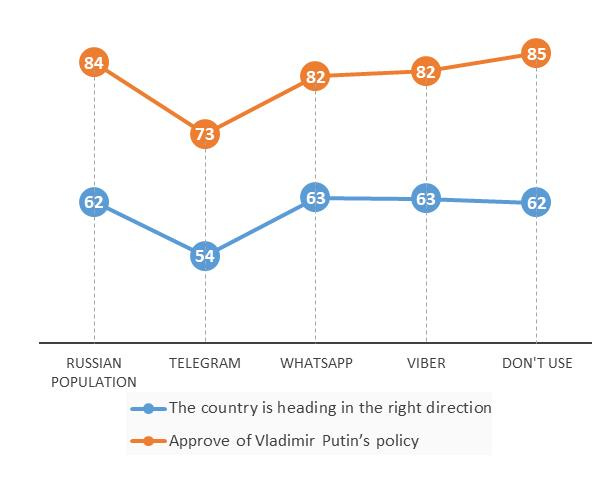

Chart: Telegram's younger user base more critical of Putin

What They're Saying

"We must implement the court's decision. We're constantly looking for new technical opportunities for the implementation of this decision."

- Minister Konstantin Noskov, on blocking Telegram

State Spending

Procurement reform stalls in the transition

THE STORY: The government announced yesterday that the transition schedule for the new state procurement system remains undecided. The Ministry of Finance may begin implementation during the second half of 2018.

DETAILS: The reform stipulates several large-scale changes. First, state and SOE procurement will transition from paper-based competitive tendering to an electronic form carried out on electronic trading platforms (ETPs) selected by the government. Second, the financial model of procurement will change: special bank accounts will now provision the tenders, and the successful bidder will pay for the tendering process.

The deadline for the decree's enactment is unclear per its language. While new requirements go into force on July 1, 2018, they will only apply to procurement notices posted on the Unified Procurement Information System (UPIS) after the government selects the new pool of ETPs to comply with the latest regulations.

In practice, this means that from July 1 until the formation of a new pool of ETPs and banks, the system of public procurement can continue as is. However, market participants note that the more delayed the transition becomes, the less time they will have to adapt to the new system. For instance, bank representatives predict that it will take half a year to open the hundreds of thousands of special accounts required for the new tendering process.

BIG PICTURE: Yes, folks. Russia still uses paper for tenders. No wonder it's so difficult to track things down and root out waste. The outcome of these reforms is vital for Anton Siluanov and MinFin, as they've seized most of the job of procurement oversight from Oreshkin and MinEkonomiki. Expect this to be resolved this summer for the sake of fulfilling the May decrees and giving Kudrin and the Audit Chamber more ammunition to root out waste.

OPINION / ANALYSIS / ODDS AND ENDS

Moscow is getting a makeover, and the rest of Russia is next. Read this excellent essay (full of pretty pictures!) about Moscow’s blagoustroistvo. [ENG]

This piece from CNN looks at how a Russian farmer outside Moscow turned to his own cryptocurrency for financing because of high interest rates for small business loans from Russian banks. [ENG]

From Kommersant: Colonel Magomed Khirziev of Dagestan's Interior Ministry was arrested for reportedly trying to buy the post of regional head of the ministry with a $2 million bribe. [RUS]

In this opinion piece from inosmi.ru, Konstantin Borovoi argues that Putin realized that continued support of Iran in the current political and geopolitical climate would have risked an escalation of sanctions to the level of an embargo and thus backed off supporting Tehran n Syria. [RUS]

Important elections are around the corner in Russia’s third and fourth largest cities this year, as Novosibirsk elects a new governor and Ekaterinburg a new city Duma. According to Andrei Pertsev, the Kremlin has launched its offensive to conquer the last islets of regional independence. [RUS]

"If you don't like my answers, then don't ask the questions”: Meduza covers Putin’s saucy interview with the Austrian media. [ENG]

Founded in 1955, the Foreign Policy Research Institute i

s dedicated to bringing the insights of scholarship to bear on the foreign policy and national security challenges facing the United States. It seeks to educate the public, teach teachers, train students, and offer ideas to advance U.S. national interests based on a nonpartisan, geopolitical perspective that illuminates contemporary international affairs through the lens of history, geography, and culture.

To keep up with FPRI daily, be sure to follow us on Twitter @FPRI and Like us on Facebook — joining our more than 250,000 fans worldwide!

For more information, contact Eli Gilman at 215-732-3774, ext. 103, email fpri@fpri.org, or visit us at www.fpri.org.